The Coworking Value Proposition – Part 3 (Commercial Real Estate)

This part of our series will take a look into the value proposition of coworking for stakeholders on the commercial real estate side of the industry. To recap, we’re exploring the value proposition of coworking across all parts of the industry for coworking space owners and operators as a guide to craft compelling messaging to attract members and provide perspective on this fast growing industry as a whole.

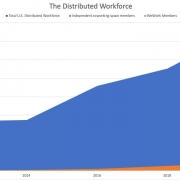

Part 1 provided an overview of the potential for the coworking industry. Coworking spaces are helping drive the decentralization of the workplace. They provide a professional office environment wherever and whenever one is needed. Through these varied locations and thoughtful flexible workplace designs, coworking spaces can contribute directly to an increase in the productivity of the workforce. As the remote workforce grows, more and more of these spaces will be needed to satisfy that demand.

As discussed in Part 2, coworking spaces are the goldilocks solution for the distributed workforce. They are less rigid than a corporate HQ, more private than a coffee shop, and less isolated than a home office. Coworking spaces meet the professional needs of the distributed workforce, but they also help meet our personal needs by decreasing loneliness and increasing autonomy in how, where, and when to work.

Coworking spaces do not exist in a vacuum, however. They are dependent upon the infrastructure and supply of commercial real estate. The “space” part of the coworking model is critical.

How does the coworking model benefit stakeholders in commercial real estate? Is it a total disruption or inevitable evolution?

For the commercial real estate world, coworking represents a fundamental shift in how office space is leased & managed. It is an inevitable and necessary shift, however. Business today changes faster than ever. Company timelines that used to span decades are down to spanning years, decreasing their willingness to sign long term leases. Employees are distributed throughout the globe. To maintain revenue stability in the commercial real estate world, coworking must become part of the standard offering.

What are the benefits of coworking?

From a leasing perspective, coworking and flexible office space can increase occupancy rates. In fact, in 2018 alone, flexible workspace accounted for two-thirds of the occupancy gains in the U.S. Office market.

Coworking businesses can lease a wide variety of commercial real estate products including traditional office space, vacant retail space, or warehouse space. They frequently transform distressed properties into Class A space.

Once open, coworking businesses attract an expanded tenant pool compared to what a particular property or market would otherwise be able to attract, increasing the utilization of the property.

Why are these benefits valuable?

Real estate is an investment business, and that means it’s all about the numbers. An increase in occupancy rate for commercial real estate means more profit for building owners, across a variety of building types used by flexible workspace. Renovated & occupied buildings return higher building valuations, which means a better return on investment in the property. Additionally, once renovated, those properties can see higher rent premiums when compared to other similar properties. (Cowork Tahoe is a great example of this)

Cowork Tahoe – Before & After renovations of the former Tahoe Daily Tribune building in South Lake Tahoe, CA

Members of coworking spaces are predominantly small businesses, free-lancers, and startups. These are clients that would not otherwise rent office space on their own, or would have to rent lower quality properties. Many of these startups and small businesses are growing, so coworking is just the entry point into commercial office space for them. Coworking is part of a sales funnel that can lead to longer-term and larger contracts between landlords and tenants as smaller companies grow and take over more space. If that space is not available in their current coworking space, they may look for nearby options, increasing the value of commercial property in proximity to the coworking space.

What is the main problem being faced by customers?

The commercial real estate world has not adapted quickly enough to the changing dynamics and demands of the business world. Companies are less and less interested in signing 10-year+ leases, particularly when they don’t know if their own timeline spans beyond a few years. Landlords need to iterate on the traditional model in a way that still provides consistent and predictable revenue streams from their properties in order to protect their investments.

How does coworking solve this problem?

The popularity of coworking is driving demand for commercial square footage across a wide range of property types and markets: primary to rural, Class A to distressed, warehouse to retail space. The flexible workspace model is increasing occupancy rates & expanding tenant pools.

Coworking directly satisfies the demand for flexible & more distributed office space that companies need, but can also provide the predictable revenue stream of a longer term lease. Members are able to rent the professional office space they need at a lower rate than they would have access to if renting themselves, they get the flexibility of shorter terms, and more choice in terms of location.

Why is coworking the best solution to these problems?

The utilization of commercial real estate as coworking space helps to derisk development in new areas or markets by offering a diversified and scalable model that can expand or contract in reaction to the local market.

Its also what employees and employers are starting to ask for – the ability to work from anywhere. That means that high quality office space must be anywhere as well. The demand for flexible workspace is growing, and CRE has the supply & infrastructure to deliver on it.